The unpredictable world of day trading can seem intimidating, but with the right knowledge and strategies, you can thrive. This guide will equip you with the essential tools to command the markets and boost your chances of gains. From understanding technical indicators to utilizing effective risk management techniques, we'll cover everything you need to become into a skilled day trader.

- Explore the secrets of technical analysis and learn how to identify profitable trading setups.

- Master fundamental analysis to assess market trends and generate informed trading decisions.

- Cultivate a robust risk management plan to preserve your capital and limit potential losses.

Embrace the disciplined approach of day trading and cultivate your skills through practice and continuous learning.

Unlocking Day Trading Profits: Mastering Strategies

The world of day trading is exhilarating and volatile, demanding both skill and discipline. While risks are inherent, mastering effective strategies can pave the way to consistent profitability. Successful/Expert/Winning day traders leverage a combination of technical analysis, market knowledge/understanding/insight, and risk management techniques to navigate the constantly shifting landscape of financial markets. A well-defined trading plan/strategy/approach serves as the bedrock for success, outlining entry and exit points, position sizing, and profit targets. Continuously educating/learning/refining your skills through market observation, backtesting strategies, and staying abreast of economic indicators/signals/trends is crucial for long-term prosperity/success/achievement in day trading.

- Fundamental/Technical/Quantitative analysis forms the foundation of informed trading decisions.

- Develop a robust risk management plan to mitigate potential losses.

- Emotional/Mental/Psychological resilience is key to navigating market volatility and avoiding impulsive trades.

Day trading mastery emerges through persistent effort, adaptability, and a commitment to continuous improvement. By honing your skills and embracing a disciplined approach, you can increase your chances of achieving/securing/reaching profitable outcomes in the dynamic world of day trading.

Unlocking Profits in Real Time: The Art of Day Trading

Day trading isn't for the faint of heart. It demands quick thinking, unwavering focus, and a gut of steel. This high-octane world requires traders to interpret market fluctuations in real time, pinpointing opportunities for profit before they vanish like smoke. It's a challenging endeavor, but for those who dominate its intricacies, the potential rewards can be exceptional.

Day traders depend on advanced strategies to command the volatile landscape of financial markets. They diligently track price shifts, news, and other variables that can impact stock prices. Their goal is to exploit these fleeting moments of volatility, trading assets within a single day to enhance their profits.

It's not just about fortune. Successful day traders possess a rare combination of strategic thinking, discipline, and an unwavering commitment to their craft. They frequently educate themselves, staying ahead of the curve and evolving their strategies to meet the ever-changing demands of the market.

Mastering the Art of Day Trading

Ready to jump headfirst into the fast-paced world of day trading? It's a journey that can be both rewarding, but with the right tools, you can transform from a beginner trader into a skilled ninja. First, you need to understand the essentials of trading: analyzing charts, spotting opportunities, and mitigating risk.

- Cultivate a solid trading strategy that aligns your goals.

- Practice your strategies in a virtual platform before diving into the real market.

- Stay informed about economic movements and developments that can affect your trades.

Bear in mind that day trading is a continuous process that requires perseverance. Refrain from get defeated by setbacks, and persistently strive to learn as a trader.

Swinging the Tide: Advanced Day Trading Tactics

Day trading is a intensive endeavor that demands keen market awareness. While basic strategies can provide a foothold, truly mastering the art of day trading requires advanced tactics to capitalize fleeting opportunities. These tactics often involve analyzing complex price movements, utilizing technical indicators with accuracy, and pivoting strategies in instantaneously.

Successful day traders cultivate an uncanny ability to predict market shifts, recognizing patterns and trends that signal potential price adjustments. They utilize a range of tools, including order types like limit orders and stop-loss orders, to mitigate risk while maximizing profit.

- One advanced tactic involves

- scalping, which aims to make small profits from rapid price fluctuations. This requires lightning-fast execution and an in-depth understanding of order structure.

- News analysis can also provide day traders with a tactical edge. By tracking breaking news and economic indicators, traders can predict market reactions and adjust their positions accordingly.

Furthermore, mastering the art of risk management is paramount for day traders. This involves setting clear profit targets, stop-loss orders to cap potential losses, and maintaining a disciplined approach to avoid emotional actions.

Unveiling the Secrets of Technical Analysis for Day Traders

Day trading can be a challenging endeavor, requiring sharp focus and keen analytical skills. However, mastering technical analysis can provide day traders with a crucial benefit. By studying price charts and market indicators, traders can identify potential trading opportunities and reduce their risk.

Technical analysis involves the use of diverse tools and techniques to analyze past price movements. Traders often rely on graphical formations to predict future price action.

Frequently Used indicators, such as moving averages, oscillators, and volume indicators, can provide valuable insights into market direction.

By implementing technical analysis strategies, day traders can increase their chances of success in this trade the day volatile market.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Batista Then & Now!

Batista Then & Now! Lucy Lawless Then & Now!

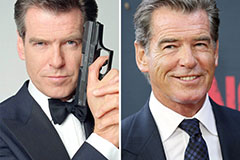

Lucy Lawless Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!